Articles & News

Get the latest news and articles from us.

Sep 10, 2024

BPV Whitelable Wallet adds Paypal PYUSD support

BPV Retail Whitelabel Wallet: Expanding Financial Connectivity with PayPal PYUSD and MoneyGram

Jun 12, 2024

Original: Blocks’ tbDEX: The Blockchain Remittance Solution That Isn’t

Cash App, the fourth most popular financial application in the US, boasts 50 million monthly active users in 2024. This represents about 17.6% of the US population, or roughly one in six consumers. Cash App's parent company, Block (formerly Square), continues to drive innovation in the financial technology space including a small startup called TBD. TBD, Unlike traditional blockchain technologies, tbDEX is an open-source, decentralized exchange protocol designed to bridge the gap between conventional financial systems and decentralized technologies like cryptocurrencies. TbDEX leverages decentralized identifiers (DIDs) and verifiable credentials (VCs) to establish trust and facilitate compliant transactions between counterparties without centralized intermediaries. TbDEX brings two key features to the table: the decentralization of Know Your Customer (KYC) data and a workflow for a Request for Quote (RFQ) system. These innovations raise important questions: Is this enough to drive adoption in the 28 Trillion dollar international payments business? Will it result in cost savings for the end customer? There are several factors indicating the project is on the right track. First, by excluding blockchain, digital assets, or stablecoins from its core solution, tbDEX alleviates concerns for remittance companies wary of jeopardizing their banking relationships, bank account access, and regulatory compliance. This strategic move makes tbDEX an attractive option for companies looking to innovate without risking their existing banking connections. Digital assets such as Stablecoins can be used - and are by US firms such as Conduit - but are not a required part of the solution. Integrating an ISO 20022 payment gateway into tbDEX would be straightforward. For our proof of concept, we used a payment in USDC, sending funds to Nigeria via Stellar. The KYC and other steps are currently mocked up, but the underlying workflow can be easily adapted for any remittance company or wallet.

May 22, 2024

BP Ventures Partners with Novatti Group to Integrate AUDD into LightEcho Oracle on Stellar's Soroban Platform

New York, May 22, 2024– BPV, a leader in fintech innovation, proudly announces a strategic partnership with Novatti, integrating AUDD, Australia's premier stablecoin, into its LightEcho Oracle on Stellar's...

May 21, 2024

BPV Joins the Circle Alliance Program Growing Stablecoin usage Worldwide

BPV, a leader in integrating stablecoin & blockchain technologies into financial institutions, is thrilled to announce its membership in the prestigious Circle Alliance Program (CAP).

Apr 25, 2024

3 Ways to drive Stellar Blockchain use

With a focus on user-friendly experiences and innovative tools, BPV is changing the way individuals and companies interact with digital assets. In this article, we'll explore three ways in which BPV solutions...

Mar 28, 2024

Three options on how to become an anchor on and off ramp on the stellar blockchain network

Setting up a Stellar anchor for your business can be a game-changer, opening up new revenue streams and giving access to hard currency, but the process isn't always easy. You've got three main options:

Mar 21, 2024

Alternatives to Magic Link wallet platform.

BPV delivers the leading wallet-as-a-service platform in tandem with asset issuance capabilities.

Dec 22, 2023

The future of UI & Key Management for Blockchain wallets in 2024

In response to the insights shared by Friederike Ernst of Gnosis on CoinDesk on the evolving landscape of blockchain technology and user interfaces, it's clear that the industry is on the cusp of a significant transformation. The move away from traditional seed phrases to more user-friendly and secure methods of account management is indeed a pivotal change. At BPV, we recognize this shift and are at the forefront of implementing these advancements.

Oct 26, 2023

Unlocking Human Potential: BP Ventures at Meridian 2023, Madrid

Madrid was the starry backdrop for this year's Stellar Meridian Conference. For its 5th edition, Meridian chose the compelling theme ’Unlocking Human Potential.’ It was a vibrant confluence of developers, founders, policymakers, and finance mavens, all focused on revolutionizing access and empowerment through blockchain technology. BPV actively engaged in the conversations that matter, focusing on the key aspects of blockchain technology that can transform financial institutions. Our work in Stellar protocol and regulatory compliance places us in a unique position to drive the sector forward.

Sep 7, 2023

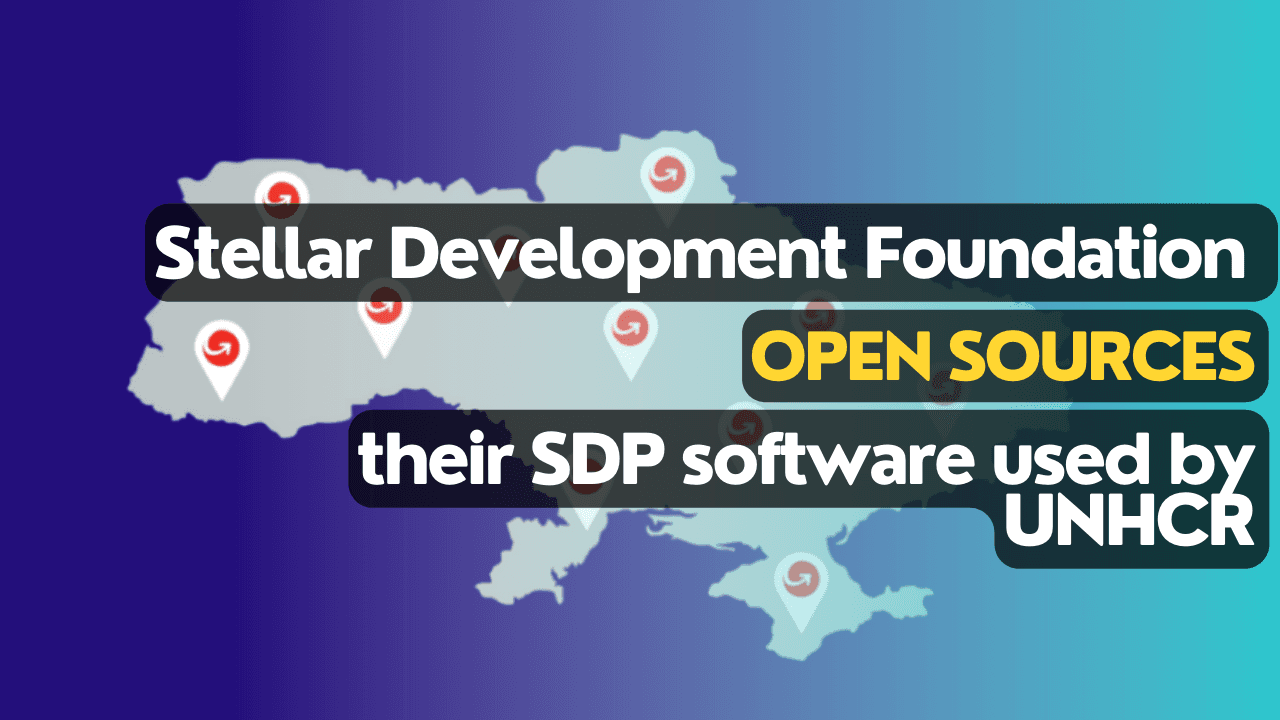

Stellar and BP Ventures: Revolutionizing Charitable Disbursements

As technological advancements reshape industries, the charity sector, often underserved by cutting-edge solutions, may be transformed by Stellar’s Disbursement Platform or SDP. A brainchild of the Stellar Development Foundation and supported by BPV, this platform promises to redefine how charities distribute aid, ensuring maximal impact for every dollar donated.

Jul 24, 2023

BPV's Stellar White-Label Wallet with MoneyGram Integration: Transforming the Way Your Customers Handle Transactions

Today, we want to introduce you to an exciting opportunity that can revolutionize your company's financial operations and add value to your customers. BPV, a trusted provider of advanced financial solutions, offers a white-label wallet that integrates effortlessly with the Stellar ecosystem, including MoneyGram. This facilitates streamlined cash-in and cash-out transactions across 180+ countries. At BPV, we understand the significance of efficient and secure financial services in today's fast-paced business landscape. By leveraging Circles USDC on the Stellar blockchain, you avoid the legal and compliance headaches of issuing a token. Plus we have combined the power of digital currency with MoneyGram's global agent network to create a customizable solution that can be offered to your end customers. Let's delve into the advantages your company can provide to its customers through this integration:

Jul 13, 2023

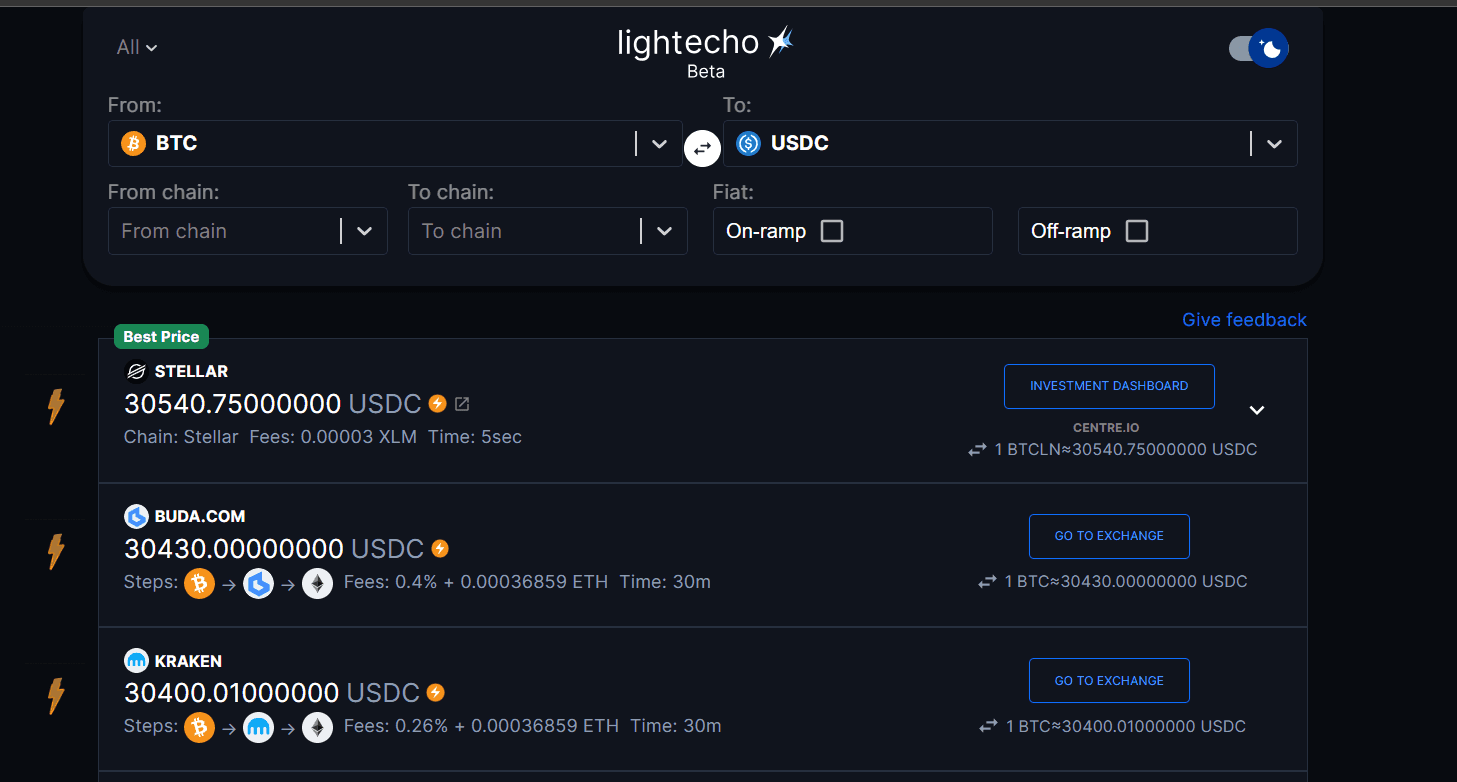

LightEcho, the First Ever Emerging Market Oracle, Earns BPV the Stellar Community Fund Award

New York, July 12, 2023 - BP Ventures, a leader in fintech, is proud to announce that it has been awarded the prestigious Stellar Community Fund Award #14 for its groundbreaking project, LightEcho Oracle. This recognition further solidifies BP Ventures" commitment to supporting the Stellar ecosystem and driving innovation in transformative solutions. LightEcho Oracle, a unique Smart Contract Price Oracle on Stellar"s Soroban system, addresses the critical need for comprehensive data coverage in advanced financial products. By focusing on emerging market currency data and XLM Volatility, LightEcho Oracle empowers developers to create inclusive financial solutions for emerging markets. "We are thrilled to receive the Stellar Community Fund Award #14 for our LightEcho Oracle project," said Christian Larsen at BP Ventures. "This recognition reaffirms our dedication to fostering innovation in the Stellar ecosystem and supporting the development of transformative solutions in the fintech industry." The Stellar Community Fund is a renowned platform that recognizes and funds exceptional projects within the Stellar community. The award acknowledges LightEcho Oracle"s potential to add significant value to the Stellar ecosystem and promote financial inclusion.

May 29, 2023

Stellar & MiCA: a Match made in Heaven?

The Markets in Crypto-Assets (MiCA) regulation introduced by the European Commission in September 2020 is a proposal aimed at providing a legal framework for crypto-assets within the European Union (EU). Its objectives include ensuring legal certainty, supporting innovation and fair competition, protecting consumers, investors, and market integrity, and ensuring financial stability (1). The MiCA regulation is set to apply from the end of 2024 and will apply directly across the EU, without any need for national implementation laws. The regulation focuses primarily on e-money tokens, asset-referenced tokens, and utility tokens. Crypto-assets offered to the public, other than e-money tokens or asset-referenced tokens, are also within the scope (1) of the regulation.

May 24, 2023

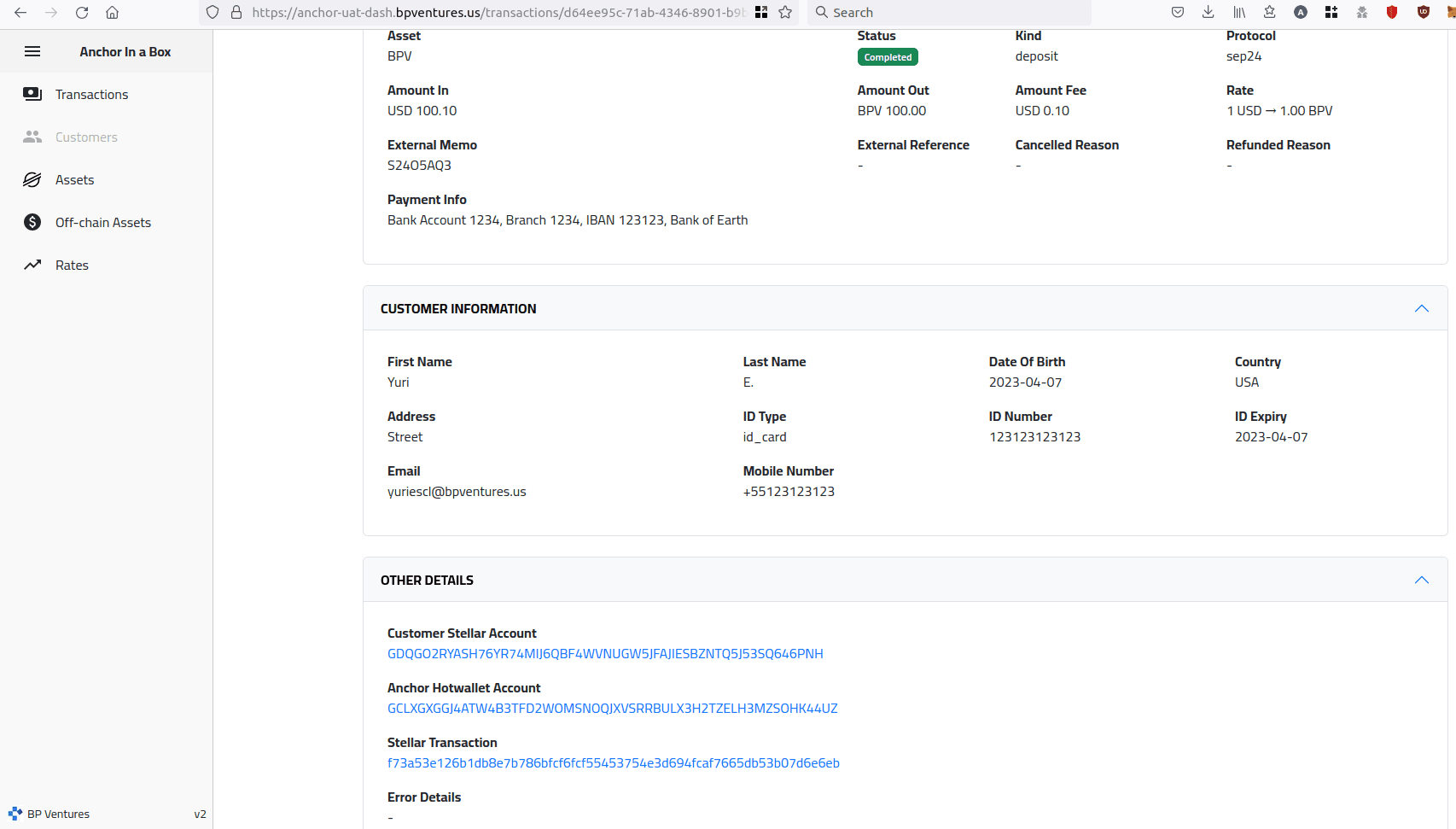

BPV's Stellar Free no-code anchor-in-a-box solution

BPV is a consulting company dedicated to helping financial institutions leverage digital assets. In this presentation, we will introduce you to the concept of a Stellar anchor, guide you on how to create or select a Stellar asset, and walk you through the process of setting up a Stellar anchor using BPV's solution. Check out our video tutorial:

May 23, 2023

BPV Unveils Free No-Code Version of Stellar Anchor-In-A-Box: Unleashing Unparalleled Benefits for On/Off Ramps and Asset Issuers

BPV is excited to announce the free version of Anchor-In-A-Box, a groundbreaking solution designed to simplify integration into the Stellar ecosystem. Aimed at two main beneficiaries—On/Off Ramps and Asset Issuers—this innovative software offers swift and simple integrations without having to worry about Stellar SEP standards as it supports SEP 1/6/10/12/24/31 out of the box. Whether you plan to offer USDC to local fiat, launch your own fiat backed token or sell securities such as mutual funds Anchor-In-A-Box offers something for you. Effortless Integration for On/Off Ramps Anchor-In-A-Box provides an ideal solution for On/Off Ramps looking to connect with a network of fiat and crypto institutions building on Stellar. With just one integration, these entities can effectively facilitate on-chain and off-chain transactions, including a wide array of digital assets including USD Stablecoins. The software simplifies the process, supports all applicable SEPs, offers robust KYC support, flexible fee structures, and comprehensive compatibility with a variety of Stellar wallets. Furthermore, it allows for direct transaction functionalities for unsupported wallets, ensuring smooth operations at all times. Empowering Asset Issuers For Asset Issuers such as mutual funds seeking to tokenize real-world value on the Stellar network, Anchor-In-A-Box provides a secure and reliable platform to efficiently manage the purchase process. The software comes equipped with advanced tracking and data scheduling features, ensuring accurate reconciliation and streamlined backend system integration. The Gateway to Stellar Network Integration BPV's free version of Anchor-In-A-Box serves as a powerful gateway for both On/Off Ramps and Asset Issuers to integrate with the Stellar network. This offering reflects BPV's commitment to making this transition as accessible and straightforward as possible. Anchor-In-A-Box acts as a bridge between traditional banking and the blockchain domain, opening up new opportunities for enhanced business operations and revenue streams. Join us in our upcoming tutorials and announcements as we guide you step-by-step through this transformative journey. Contact: support@bpventures.us

May 19, 2023

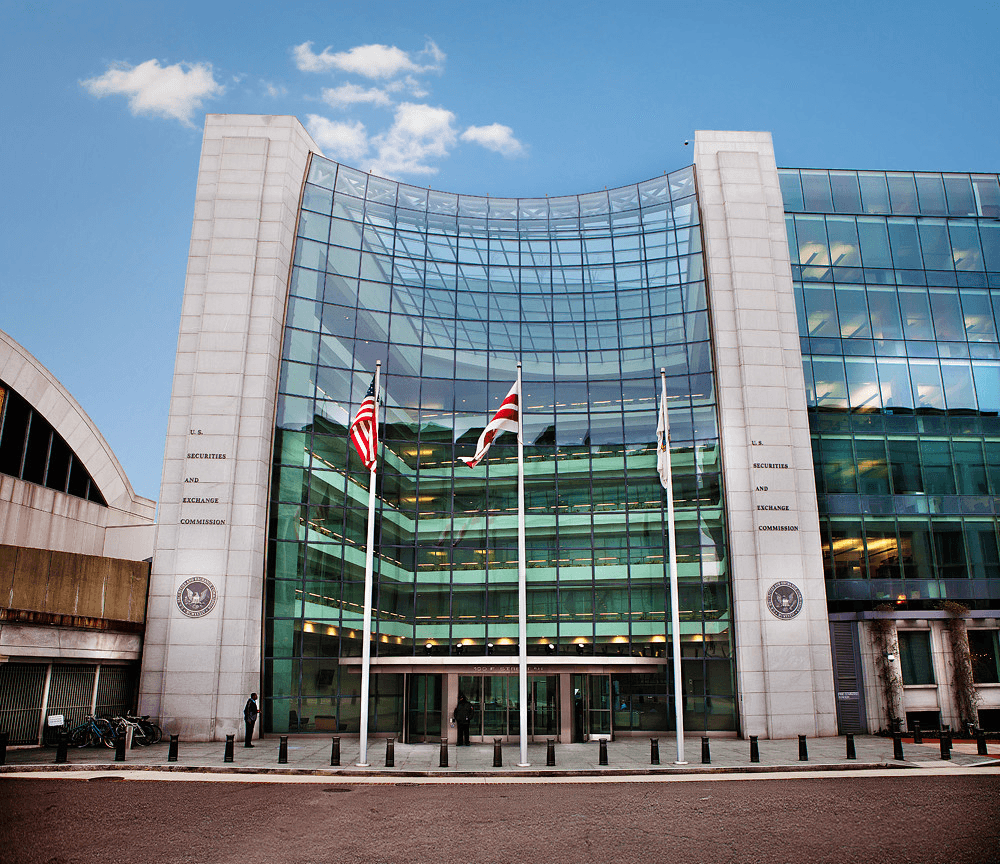

Blockchain and Mutual Fund Reform: Charting a Course in Uncertain Waters

2023 is a time of challenge and innovation for the American mutual fund industry. At the heart of the issue is the Securities and Exchange Commission's (SEC) latest set of proposals. On the surface, they aim to fortify open-end funds against the kind of market turmoil we've seen before. Yet, the feedback from the industry is anything but positive. Let's dissect these proposals and ponder the potential of blockchain as a viable countermeasure. First on the SEC's docket is Liquidity Management. It calls for mutual funds and certain ETFs to keep 10% of their net assets as highly liquid. This is clearly a direct response to the liquidity crisis during the COVID-19 market upheaval and recent banking turmoil. However, the mutual fund industry contends that this approach oversimplifies the nature of fixed-income investments, many of which may rarely make it to the trading table. The Hard Close, another SEC proposition, would place a strict cut-off at 4 p.m. Eastern Time for mutual fund trading. It's a ruling that might cause consternation among those with defined contribution plans who can't always meet the 4 p.m. deadline, forcing them into a less favorable next-day price. The potential fallout, a potential shift of assets to more flexible financial products, ironically at the cost of investor protections and higher expenses. Furthermore, we have a Swing Pricing proposal. The SEC suggests that fund values should swing with trading activity, making investors who exit pay their own way out, thus avoiding dilution for those who remain. While this seems fair, it comes with a baggage of operational difficulties and transparency issues as investors won't know if swing pricing is in effect until after their transaction is processed. Enter the potential blockchain remedy. The Stellar blockchain, known for its ability to upend traditional financial systems, presents some interesting solutions to these challenges: The prospect of 24/7 trading in blockchain-powered mutual funds can render the proposed hard close rule obsolete, giving investors the freedom to make transactions whenever they wish. Blockchain's potential for cost efficiency is a game-changer. By drastically reducing transaction fees, it keeps mutual funds in the competitive race, allaying fears about investors seeking greener pastures with less restrictive financial products. Transparency and security, hallmarks of the blockchain, partially address investor concerns about the ambiguity of swing pricing. Transactions are visible to all participants and are immutable, which boosts transparency. Plus, the decentralized and encrypted structure of the blockchain fortifies security, lowering fraud risk. Instant transaction processing, another feature of blockchain, helps maintain liquidity even during market shocks, as investors may buy or sell fund shares on demand. Of course, while blockchain's potential is tantalizing, we are still in the early innings of its application in the mutual funds industry. Nevertheless, as the sector weathers regulatory shifts and seeks innovative solutions for investor concerns, the blockchain is part of the solution roadmap to consider. The mutual fund industry's destiny may increasingly be tied to how it embraces and adapts this potentially revolutionary technology. Firms like Franklin Templeton are already seeing exponential blockchain growth. BPV provides tools for Financial firms such as mutual funds to issue and manage funds on the Stellar Blockchain. For a personalized demo please email support@bpventures.us today.

May 14, 2023

Introducing LightEcho: A Next-Generation Smart Contract Price Oracle on the Stellar Soroban Platform

BP Ventures is delighted to introduce the Lightecho Oracle, a pioneering Smart Contract Price Oracle on Stellar's Soroban system, as an essential addition to the ecosystem. The Lightecho Oracle aims to fill in the gaps left by existing data providers, offering extensive coverage and depth of market data that is vital for advanced financial products. One of the Lightecho Oracle's distinguishing features is its focus on providing emerging market currency data. With our extensive experience and deep expertise in handling these types of data feeds, we are able to offer a service that many other oracles do not cater to effectively. This focus empowers developers and companies to create more diverse and inclusive financial solutions, particularly for underrepresented and developing markets. Where Chainlink's functionality is limited by the reliance on a token that does not exist on Stellar, the Lightecho Oracle is fully integrated with the Stellar ecosystem, ensuring seamless operation and accessibility. Orbitlens is working on an oracle data similar to Uniswap TWAP. While they continue to explore innovative ideas, they do not provide emerging market data or traditional market data. This is precisely the void Lightecho Oracle aims to fill while modeling our smart contract to be a similar smart contract code structure so switching between the two should be trivial. In conclusion, the Lightecho Oracle, with its extensive coverage of traditional and emerging market data, is poised to be a crucial addition to the Stellar Soroban ecosystem. Our mission is to provide developers and companies with the most accurate, comprehensive, and timely data possible, empowering them to build more sophisticated and inclusive DeFi solutions. To give some background detail The Stellar blockchain, known for its high-speed, low-cost transactions, is now further enhanced with Soroban, a developer-friendly, Rust-based smart contracts platform. Currently live on the test network, Futurenet, Soroban integrates seamlessly with the existing Stellar blockchain, offering developers a powerful, scalable environment to create innovative applications. Lightecho, in its capacity as a robust, next-generation price Stellar Oracle, capitalizes on Soroban's features. By providing reliable, tamper-proof, and up-to-date price feeds, Lightecho enables developers to create sophisticated DeFi applications, including lending platforms, automated market makers, and derivatives markets. Moreover, by making emerging market data accessible, Lightecho can empower developers to design DeFi solutions that cater to the unique needs of diverse markets, promoting financial inclusion and global growth. Furthermore, our oracle will include data like XLM volatility feeds, enabling options. Starting today, Lightecho Oracle is available for developers, who can access the codebase and begin integrating the smart contract into their projects by visiting https://github.com/bp-ventures/lightecho-stellar-oracle. BP Ventures is committed to supporting the Stellar ecosystem, fostering innovation, and fintech solutions that empower companies and developers to create new, transformative solutions. About BP Ventures: BPV, a leader in fintech, empowers financial institutions to leverage digital assets for operational optimization and revenue growth. With a seasoned team experienced in Stellar protocol, regulatory compliance, and IT systems, BPV specializes in software for digital asset custody, secure management, and tokenized asset trading, driving the future of decentralized finance. For more information, please contact: Christian Larsen support@bpventures.us

Apr 3, 2023

5 Reasons Why Stellar Blockchain is the Best for Remittances in 2023

Technology is changing fast, and money transfer businesses and financial institutions need to keep pace. But with so many different options for digital transformation, choosing the right tech can be extremely difficult. Unlike many other blockchain networks, the Stellar network was designed from the ground up with remittances in mind. Not surprisingly, it has a number of excellent properties for remittances. Here are five reasons why we believe that the Stellar blockchain is the best for remittances in 2023. Inexpensive Everyone loves to send money for free. With the Stellar blockchain payments cost only 0.00001 XLM or approximately 0.000001 USD. Fast Payments settle in under 5 seconds. When was the last time you sent money internationally in less than 5 seconds? Growing rapidly Stellar already supports more than 180 countries via its Moneygram integration. There are over 20 payment on/off ramps called “anchors.” These anchors provide support to countries like Brazil, Argentina, Mexico and Nigeria and USA via the USDC token. Coinme recently added over 40,000 cash in and cash out locations in the United States. Multifunctional Stellar has anchors for most major crypto currencies used for payments, including XLM, XRP, USDC, Bitcoin Lightning and Litecoin. It also has a built-in distributed exchange and liquidity pools for swapping currencies. Smart Contracts The Soroban smart contract system was introduced to Stellar in 2023. This system will allow users everywhere to access DeFi functionality for saving, trading, and borrowing. We have helped multiple businesses cut costs, increase profits, and improve overall efficiency by integrating Stellar into their workflows. Contact BPV Sales today to schedule a demo of our Stellar based remittance suite.

Mar 22, 2023

BPV announces ISO 20022 support for the Stellar blockchain and Circle USDC

BP Ventures, a blockchain consulting and software services firm, has completed development of support for ISO 20022 on the Stellar blockchain. The move will open possibilities for trillions of dollars worth of financial sector transfer volume to migrate to the Stellar network. Developed by the International Standards Organization, ISO 20022 is a global standard for data transfer between financial institutions essential for many types of electronic payments. The standard is already used by many real-time clearing systems around the world such as SWIFT, SEPA in Europe, Faster Payments in the UK as well as many other payment systems. ISO 20022 is used for payment settlements as well as the settlement of stocks and other securities. By standardizing transfer and compliance protocols, companies can cut costs and reduce risks. SWIFT is scheduled to implement the standard in March 2023. BPV has developed ISO 20022 support for Stellar’s standardized KYC rails, which were implemented via Stellar Ecosystem Proposals (SEP) 9 and 31. Now, payments and other asset transfers will be able to leverage the benefits of Stellar— such as 5 second settlement, low fees, and immediate finality— while at the same time processing all transaction meta data according to the new ISO 20022 standard. “We believe that we have implemented the most robust mapping of ISO 20022 XML to date. This will allow banks and financial institutions everywhere to benefit from Stellar’s blockchain technology, the stablecoin Circle USDC, and remain compliant with ISO standards,” said Founder of BPV, Anthony Barker. The impact of ISO 20022 covers many data types beyond payments, including transaction monitoring, client reporting, asset settlement and other elements, so planning for migration early is important for financial institutions worldwide. Barker believes that the implementation of the standard presents an opportunity for financial institutions to upgrade their infrastructure. “The whole financial sector will need to restructure their workflows to reflect ISO 20022 compliance. This new integration on the Stellar network makes it possible to improve operational efficiency while achieving compliance with the new standard at the same time.” BPV is a US-based blockchain software services and consulting firm. Founded by two fintech entrepreneurs with extensive Web3 experience, the company helps financial institutions increase efficiency, security, and market reach by integrating blockchain digital asset management solutions into their workflows. references: https://www.jpmorgan.com/solutions/treasury-payments/insights/what-is-iso-20022 https://www.bis.org/cpmi/publ/d215.htm https://www.swift.com/news-events/news/why-adopting-iso-20022-good-you-and-your-clients

Mar 7, 2023

Ethereum vs. Stellar - Which blockchain platform is best for Security Tokens?

The world of digital finance has witnessed an explosion in recent years, and security tokens have become one of the hottest topics recently as the space moves toward real-world use cases in the face of centralized exchange blow-ups. “Security tokens” are tokens that represent real assets, including ownership of real assets, revenue sharing (like stock dividends), futures, options, mutual funds, or a combination of these attributes. Security tokens offer a new way of raising funds, and providing secondary markets, since they allow access to a global market of investors, as opposed to traditional stock markets which generally operate within a single country. When it comes to launching a blockchain based security token, two of the most popular platforms are Ethereum and Stellar. Both platforms have their own unique advantages and disadvantages. Why are so many companies issuing security tokens? The first question many people ask is why issue on a blockchain? Countries such as France, Germany and others have implemented DLT laws in which blockchains represent legal records for issuing equity, like shares in publicly traded companies. But is there really an advantage in using them? Currently, issuing tokens at many banks or brokerage firms is relatively “old school” when it comes to securities. Their “stack” might look something like this: Excel spreadsheets for recording allocations. Manual emails to get an ISIN (International Securities Identification Number). Phone calls to verify shareholder participation. Manually creating new tokens in the back book of record. Manual allocation of the security to various accounts. Manual review of legal documents. In the case of shares, after-issuance custodianship is often managed by a local legal custodian. If a bank is the issuer, the bank itself may handle management. If the securities are issued on a stock exchange there can be quite a few listing, legal, and audit fees. Typically, the issuing broker takes a fee of approximately 5%. The overall costs for a new listing can cost up to 20% of the capital raised. After this there are audit costs, listing fees, marketing making costs and ongoing legal fees. Issuing a security on a blockchain means eliminating many or most of these costs, dramatically lowering costs and often improving operational efficiency and reducing human error. In the US remaining listed on a major exchange typically can cost up to 1 million per year. And custodians such as BNY Mellon can charge up to $10 USD for every transaction if the shares are listed overseas. So in short DLT or Blockchains can automate a lot of semi manual processes, remove middlemen and allow for self custody. Advantages of Ethereum Ethereum’s main advantages are that it has a large developer community and a large pool of on-chain liquidity. More developer support means there is a huge range of software tools and libraries, which gives you a lot of flexibility in terms of what you can do as well as making development easier. For example, Ethereum smart contracts use the Ethereum Virtual Machine (EVM) for creating smart contracts. This makes it possible to automate many functions of a security, such as distribution, dividend payouts, and voting. Additionally, Ethereum has a relatively mature infrastructure, including decentralized exchanges and wallets that support security tokens such as those following the ERC-20 format or ERC-223. If you are concerned about security you can leverage the OpenZepplin contact format to ease issuance. This means there are lots of venues for trading and storing the token, and more options for selling tokens and moving the proceeds into traditional bank accounts. Disadvantages of Ethereum Ethereum has been plagued by slow transaction speeds, criminal activity, and high fees. The Ethereum network is prone to congestion during periods of high demand, which can slow down transactions and increase fees. This can be a problem for security token issuers who need to transfer large amounts of tokens quickly, compliantly, and cost-effectively. Advantages of Stellar Stellar, on the other hand, is known for its fast transaction speeds, low fees, and built-in infrastructure for regulatory compliance. The Stellar network can process thousands of transactions per second, making it ideal for security token issuers who need to transfer large amounts of tokens quickly. While the Stellar ecosystem is not as big as Ethereum, there are still plenty of high quality wallets, exchanges platforms to use as tools when working with the network. Stellar also has a user-friendly developer interface since it is targeted more toward the financial sector, whereas Ethereum is more oriented toward software developers and can have a steeper learning curve. Stellar also does not have some of the reputational issues as Ethereum, which has seen a number of high-profile hackson smart contracts. Stellar has some features that make it perfect for issuing security tokens— in particular, clawback can be used to issue options or futures contracts with predetermined expiration dates. It also includes a built-in, standardized KYC process. Another feature that helps token issuers to comply with securities laws is SEP-8 (Stellar Ecosystem Proposal 8). This standard allows a company to block trades that might be illegal, such as spoofing, smurfing, or crashing the price of a security beyond some set limit. Disadvantages of Stellar Stellar definitely has much less flexibility than Ethereum when it comes to more exotic and experimental decentralized finance applications. This relative lack of flexibility is a natural result of Stellar’s higher security and ease of use. That said, Stellar plans to launch its 2nd generation Rust based smart contract platform named Soroban in the near future. This includes an automated wrapping mechanism for classic stellar assets and most of the capabilities of EVM based chains.

Feb 28, 2023

BPV Releases Open Source Digital Asset Wallets for Stellar Blockchain

BP Ventures, a leading digital asset direct custody solution provider, has announced it has launched three new open source crypto wallets, to help companies integrate with the Stellar Blockchain. This open sourcing demonstrates BP Ventures' commitment to supporting the growth and development of open blockchain networks. "These tools will help companies connect with Stellar - we believe in the potential for blockchain technology to make a positive impact on the world," said Anthony Barker, founder of BPV. White Label Digital Retail Wallet for Stellar: The white label retail wallet is an open source tool that supports SEP 24, SEP 6, swapping, and Android (APK available) written in NextJS.

Feb 22, 2023

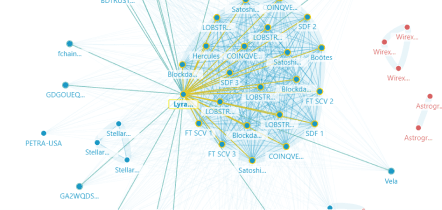

BPV Announces Sponsorship of Public Node's Stellar Hosting

BPV, a leading digital asset direct custody solution provider, has announced it will sponsor andmonitor the uptime of The Lyra node at Public Node. Public Node is a 501(c)(3) nonprofit open- membership orga...

Feb 10, 2023

BPV Spring Events Schedule 2023

Spring 2023 is looking great for BP. Here is a short list of events our team will be attending. Reach out to us to setup a one on one meeting or demo of our enterprise non custodial stellar wallet, Anchor in a Box, or other products.

Oct 23, 2022

BPV Attends Money 20/20 Conference in Las Vegas

Las Vegas, NV - BPV was proud to participate in the recent Money 20/20 conference in Las Vegas. The event, which took place from October 23rd to October 26th, 2022, was the world's largest event focused on payments and financial services innovation. At the event, BPV's team was on hand to provide industry leaders and influencers with valuable insights into the future of blockchain and how it will shape the financial services industry. BPV provides software development, tokenization and blockchain strategy consulting services orientated towards fintech, banks, brokers, insurance companies, and authorized payment institutions. The company offers expert guidance and support to help these organizations effectively integrate blockchain into their existing payment infrastructure, to drive growth and maximize returns. “We were thrilled to attend Money 20/20 and share our expertise with the broader financial services community.“ said Jeffery Phaneuf, Director & Co-Founder of BPV. Money 20/20 is the largest global event focused on the payments and financial services ecosystem. The conference attracts a diverse range of attendees, including payment providers, financial institutions, technology companies, and startups. This year's event featured a range of keynote speeches, panel discussions, and networking opportunities, providing attendees with a unique platform to exchange ideas. BPV's attendance to Money 20/20 is a testament to the company's commitment to advancing the field of payments through innovative and effective blockchain solutions. To learn more, reach out to meet us at our upcoming conferences.

Oct 20, 2022

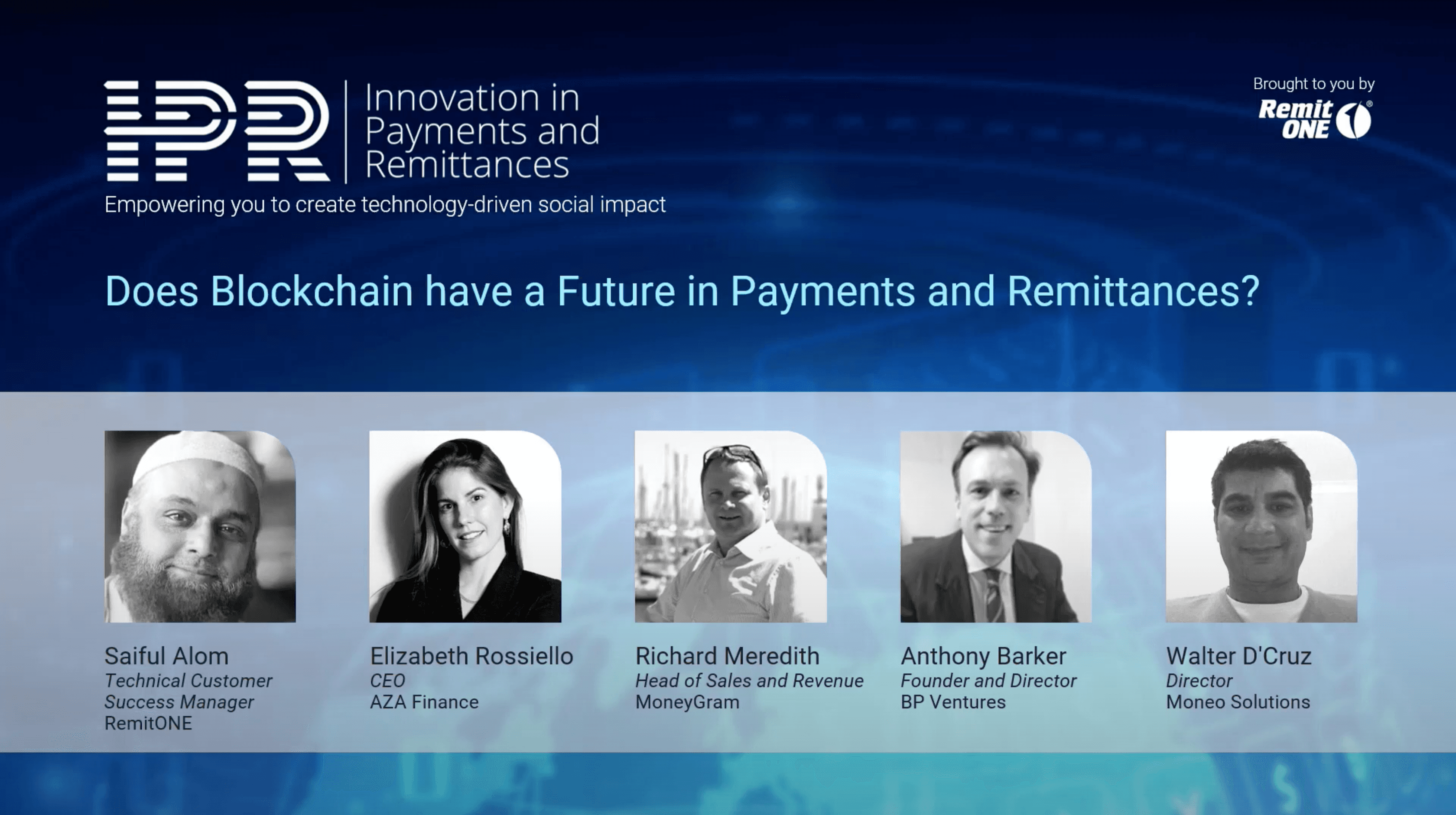

Anthony Barker, CEO of BPV, Spoke at IPR Global Event 2022 Panel on Blockchain and Payments

London, UK - BPV is pleased to announce that its CEO, Anthony Barker spoke at IPR (Innovation in Payments and Remittances) Global Event 2022 panel on “Does Blockchain have a Future in Payments and Remittances?”. The panel discussion explored the ongoing rapid growth of stablecoins as a payment method, common misconceptions about the risk of using blockchain in relation to whitelisting and elliptic, and methods to work with regulators productively. Alongside Moneygram, Bitpesa, and others, Anthony shared his insights on the intersection of growing blockchain innovation and traditional TIER 1 financial institutions. Anthony has extensive experience helping protocols like Stellar and Ethereum integrate with the traditional financial world. He shared his expertise on the panel on how start-ups can take manageable and risk-free steps into the digital currency space, with use cases for money transfer organizations (MTOs) and larger financial institutions. IPR panel discussion highlighted the increasing trend of tech-savvy customers seeking out digital options, and the potential for blockchain technology to improve the security and efficiency of transactions for MTOs and other organizations. With its cutting-edge blockchain technology used to issue and manage digital assets, BPV is well-positioned to help MTOs and other organizations navigate this rapidly evolving landscape and stay ahead of the curve. The company remains committed to advancing the use of blockchain and digital currencies in the payments sector and empowering its clients to succeed in this dynamic and exciting space. IPR Global Event provided a unique opportunity for attendees to gain a deeper understanding of the role of blockchain and digital currencies in the payments sector. Watch the video of the panel here: Anthony Barker, CEO of BPV, Speaks at IPR Global Event 2022 .

Aug 2, 2022

Integrating Stellar Network into your SME business

Stellar, like almost all encryption systems and blockchain payments works with Public-key cryptography(1) that was invented in the 1970s where the public key is the address where you receive funds. Early on Stellar supported human style names that look like anthony*tempo.eu.com, +33123123*tempo.eu.com and jsmith@gmail.com*tempo.eu.com with a system called federation(2) which does a simple https get to pull information. This is great as it easier to type and remember than the stellar public key which looks something like: “GC2BQYBXFOVPRDH35D5HT2AFVCDGXJM5YVTAF5THFSAISYOWAJQKRESK” Smart anchors such as flutterwave.com have used federation with the format account_number.swiftcode*flutterwave.com. When a wallet does a federation lookup flutterwave validates the bank account number and swift code. Quite cool and is much more simple and less expensive than ethereum’s lookup system called Ethereum ENS. Bitcoin implemented bip 0021 in 2012 (3), which is used for payments. It looks a bit like a uri and can be used as one as was registered with iana.org (4). It can also be converted to a QR code. bitcoin:175tWpb8K1S7NmH4Zx6rewF9WQrcZv245W?amount=20.3 In the Stellar world the first few wallets also supported QR code conversion and with a bit of prodding Centaurus, Lobstr, Stargazer, Papaya all currently work well together.

Jul 11, 2022

BP Ventures Wins Stellar Foundation Prize

BP Ventures, a US consulting & software service solutions firm that helps FinTechs leverage blockchain payments by using USDC as a settlement mechanism was selected out of 47 finalists to win a $125,000 gra...

Jul 18, 2018

Another Crypto Wallet for Stellar based assets such as ETH, BTC or EURT?

There are a ton of wallets available according to Stellar.org website. However, none of them did exactly what I needed. So in the past I have used the ipython shell to create address, make trustlines, and send payments. I spent a Saturday and put together a tiny wallet. stcli— a repl command line crypto wallet for stellar that is simple and all in one file Why a new wallet? Super easy to read the code — You are trusting wallet providers with your funds and I wanted someone to be able to review the code in about 3 minutes to ensure nothing funny is going on under the covers. Currently it is less than 600 lines of code including comments and it all is in 1 file so you can move it around easily and securely. Command line under Linux — I love the command line and specifically python’s REPL (Read–Eval–Print Loop ).. Python based wallet — all the other open source ones are in Javascript or go Used for testing of Stellar remittance functions — No other wallets I could find fully allowed testing of federation, compliance, deposit, and withdrawal. Shows 100% what it is doing behind the scenes — made for testing (or live) Support all the basic functions that other wallets do from this list by Tim https://docs.google.com/spreadsheets/d/14hs18NkgKerF47YPI0NQDX0gN2ZAN98Z0LValHGYrZ8/edit#gid=987160927

Jul 9, 2018

Stellar payments — thoughts on federation, QR Codes, URIs, and Point of Sale systems within the Stellar.org ecosystem

Stellar, like almost all encryption systems and blockchain payments works with Public-key cryptography(1) that was invented in the 1970s where the public key is the address where you receive funds. Early on Stellar supported human style names that look like anthony*tempo.eu.com, +33123123*tempo.eu.com and jsmith@gmail.com*tempo.eu.com with a system called federation(2) which does a simple https get to pull information. This is great as it easier to type and remember than the stellar public key which looks something like: GC2BQYBXFOVPRDH35D5HT2AFVCDGXJM5YVTAF5THFSAISYOWAJQKRESK Smart anchors such as flutterwave.com have used federation with the format account_number.swiftcode*flutterwave.com. When a wallet does a federation lookup flutterwave validates the bank account number and swift code. Quite cool and is much more simple and less expensive than ethereum’s lookup system called Ethereum ENS. Bitcoin implemented bip 0021 in 2012 (3), which is used for payments. It looks a bit like a uri and can be used as one as was registered with iana.org (4). It can also be converted to a QR code. bitcoin:175tWpb8K1S7NmH4Zx6rewF9WQrcZv245W?amount=20.3 In the Stellar world the first few wallets also supported QR code conversion and with a bit of prodding Centaurus, Lobstr, Stargazer, Papaya all currently work well together.